INTER DYNAMICS PTE. LTD

Slogan: Connecting Values – The Future Ste

COMPANY OVERVIEW

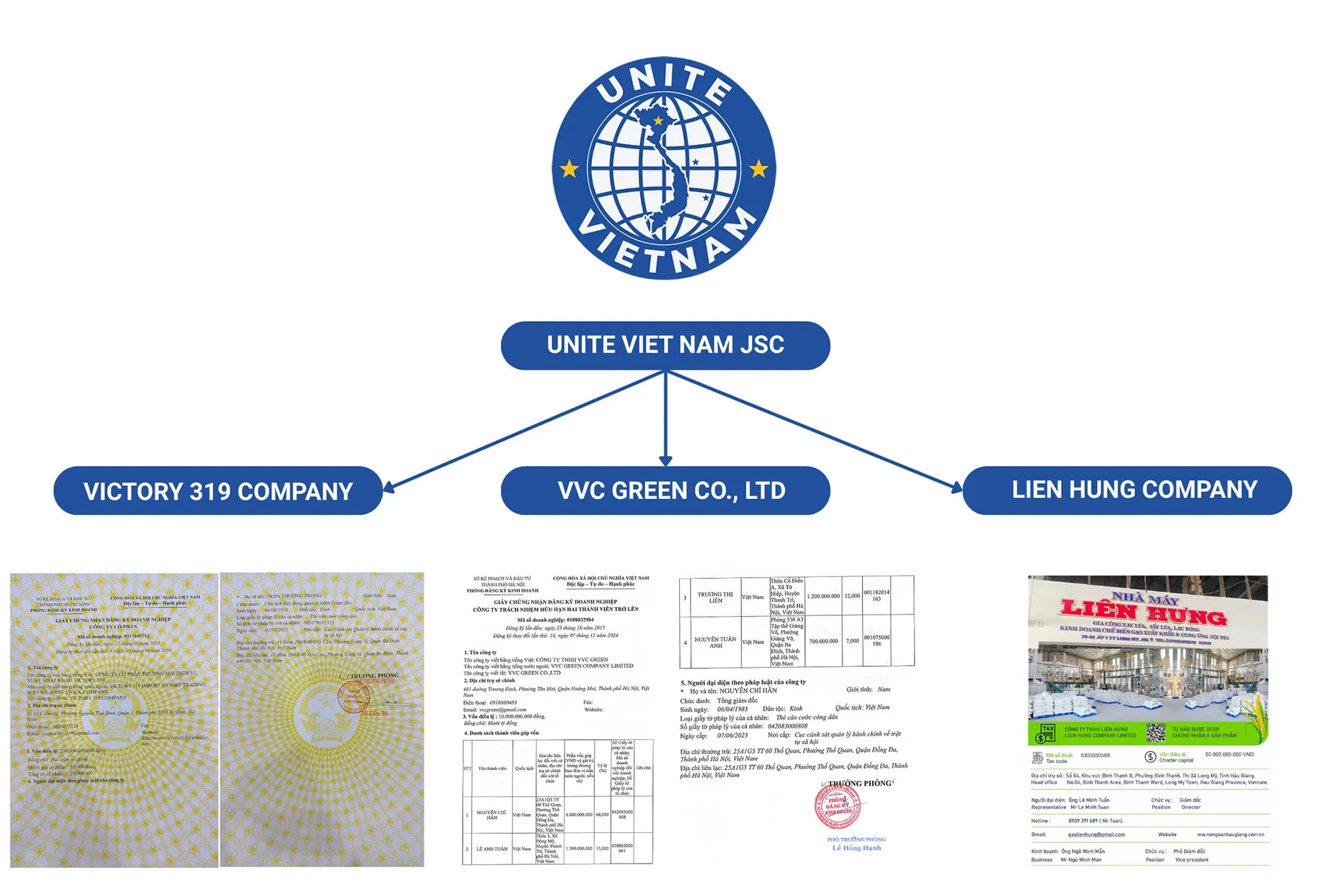

INTER DYNAMICS PTE is a dynamic and diversified corporation headquartered in Singapore. We specialize in multiple sectors, including trade, real estate, hospitality, logistics, and technology. With a robust ecosystem of subsidiaries, we aim to create sustainable values for our clients, partners, and communities.

Since our establishment, INTER DYNAMICS PTE has been committed to becoming a trusted partner in both domestic and international markets. We focus on building long-term relationships and delivering premium-quality services with professionalism and integrity.

VISION - MISSION - CORE VALUES

- Vision: To become a leading Vietnamese corporation with global reach, driving sustainable growth through innovation and collaboration.

- Mission: Connecting values, creating future-oriented solutions, and delivering excellence to all stakeholders.

- Core Values: Integrity – Innovation – Collaboration – Sustainability.

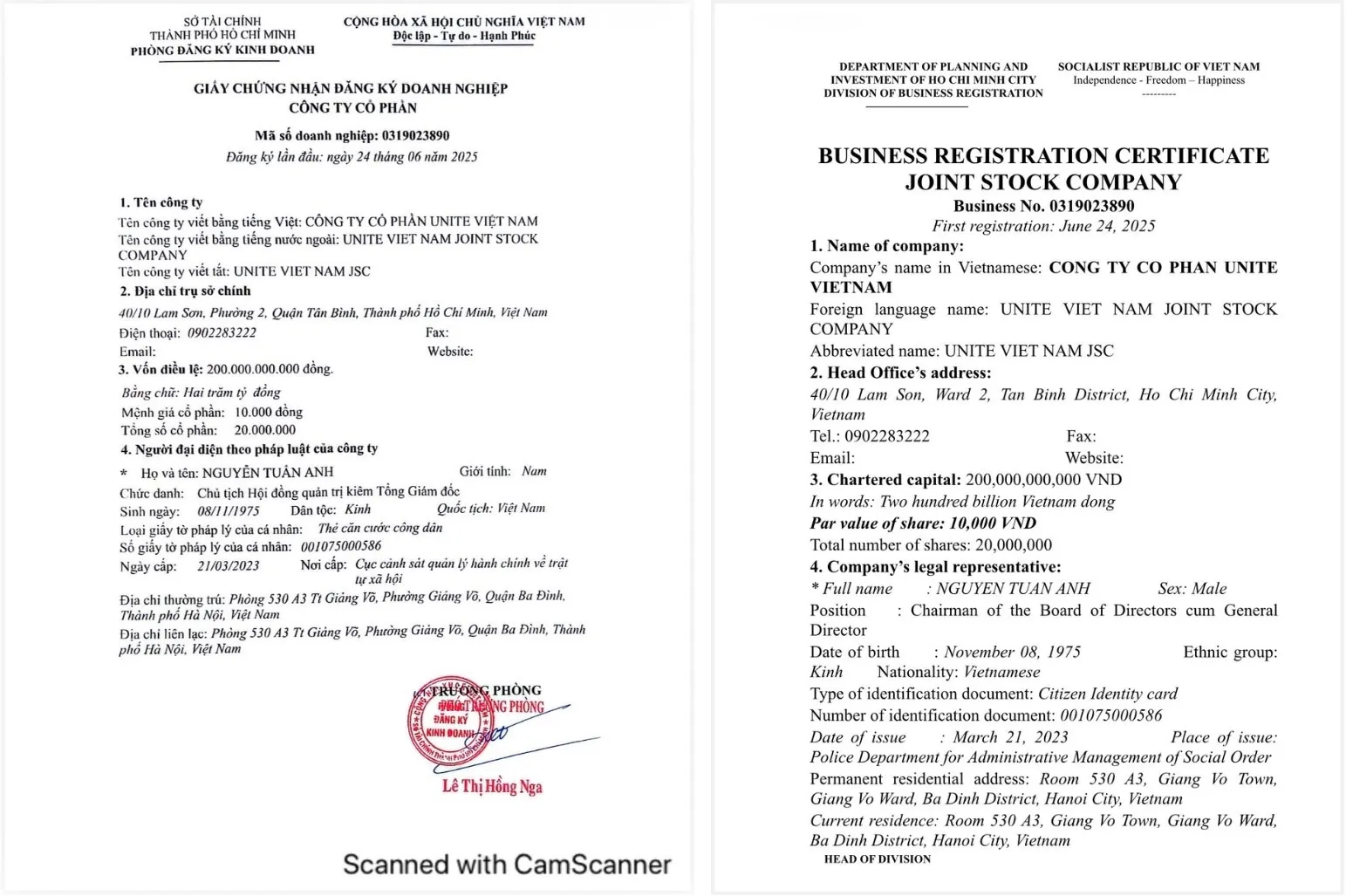

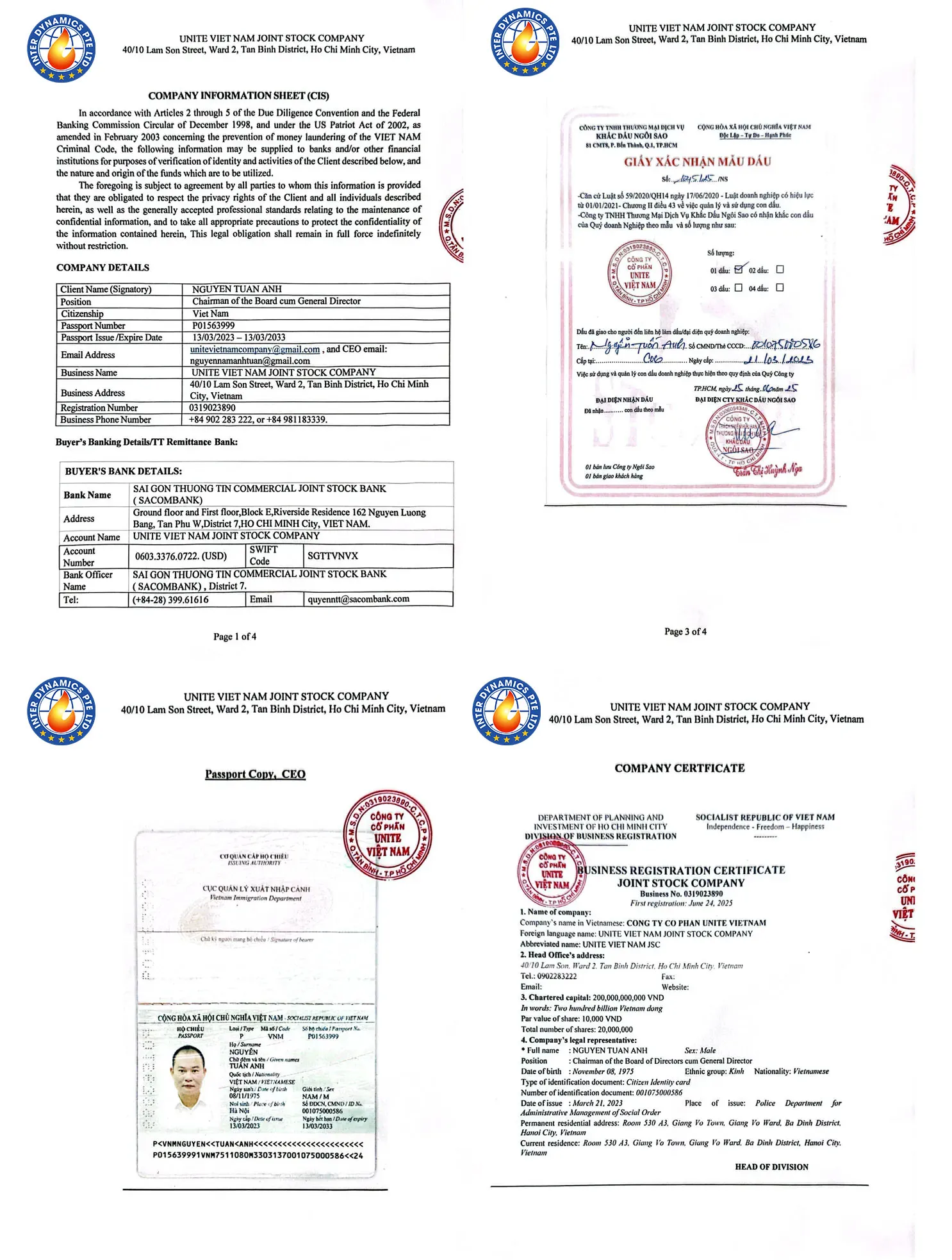

LEGAL INFORMATION AND REGISTRATION DETAILS

- Company Name: INTER DYNAMICS PTE. LTD

- Business License: Issued under the Enterprise Law No. 59/2020/QH14.

- Registered Capital: 200,000,000,000 VND (200 billion VND).

- Head Office: 138 Robinson RW, Road, 24-01 Oxley Tower,.Singapore.068906

- Business Term: 50 years from the date of registration.

Company Charter

SOCIALIST REPUBLIC OF VIETNAM

Independence – Freedom – Happiness

------------------------------------

CHARTER

INTER DYNAMICS PTE. LTD

We, the founding shareholders, are as follows:

|

No. |

Name of founding shareholder |

Date of birth for individual founding shareholders |

Sex |

Nationality |

Contact address for individual founding shareholders or head office address for organizational founding shareholders |

Type, number, date, issuing authority of Legal documents of individual founding shareholders; Legal documents of organizations for organizational founding shareholders |

|

|

1 |

Nguyen Tuan Anh |

November 08, 1975 |

Male |

Vietnamese |

Room 530 A3 Giang Vo Town, Giang Vo, Ba Dinh, Hanoi |

001075000586 - March 21, 2023 - Police Department for Administrative Management of Social Order |

|

|

2 |

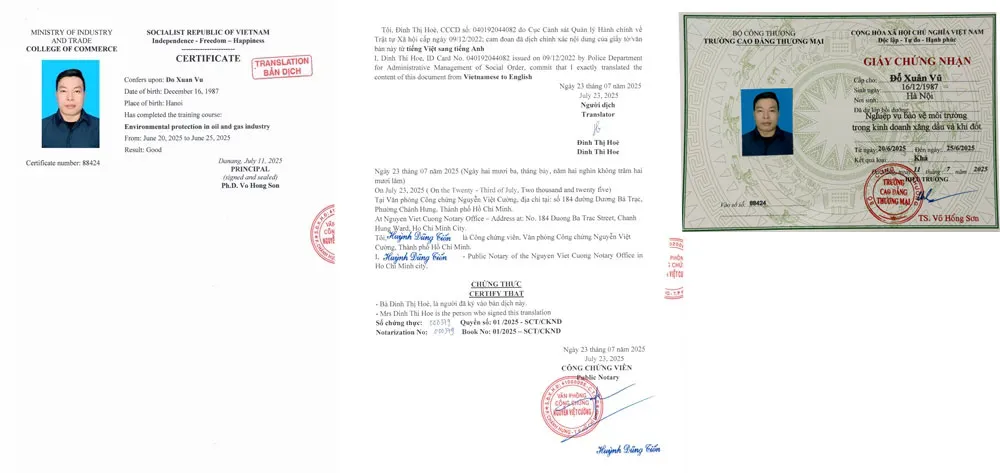

Do Xuan Vu |

December 16, 1987 |

Male |

Vietnamese |

Trai Ho, Co Dong, Son Tay, Hanoi |

001087054523 - February 15, 2023 - Police Department for Administrative Management of Social Order |

|

|

3 |

Luong Kim Thoai |

April 20, 1985 |

Female |

Vietnamese |

Group 11, Quarter 1, Tan Chau, Tan Chau, Tay Ninh |

072185002902 - July 18, 2023 - Police Department for Administrative Management of Social Order |

|

|

4 |

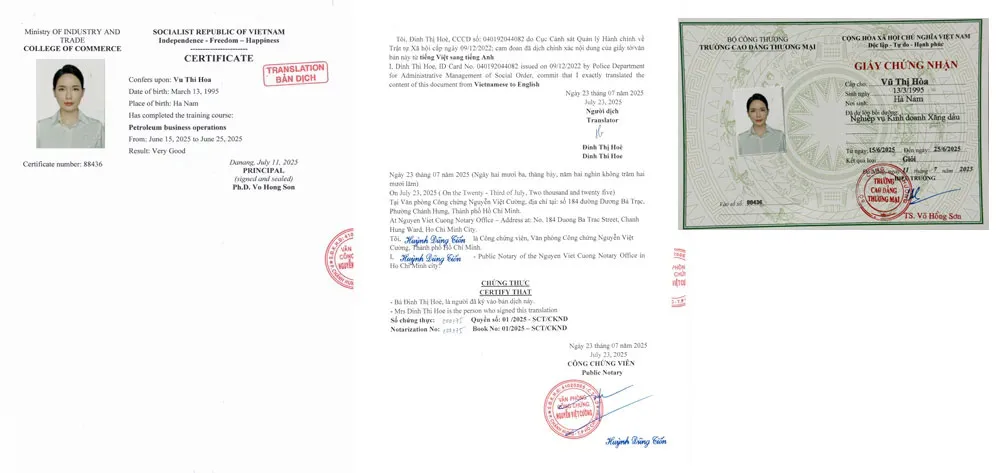

Vu Thi Hoa |

March 13, 1995 |

Female |

Vietnamese |

174 National Highway 37, Group 4, Tan Thanh, Thai Nguyen, Thai Nguyen |

019195008332 - May 9, 2023 - Police Department for Administrative Management of Social Order |

|

The shareholders agree to sign and approve the establishment of INTER DYNAMICS PTE Joint Stock Company with the Charter approved by the company's shareholders in accordance with the provisions of the Enterprise Law No. 59/2020/QH14 passed by the National Assembly of the Socialist Republic of Vietnam on June 17, 2020, including the following articles and provisions of this Charter:

Chapter 1

GENERAL PROVISIONS

Article 1. Legal status, scope of responsibility, term of operation

1. The Company is an independent legal entity and has legal status under the Law of Vietnam. All activities of the Company are governed by the Law of Vietnam and in accordance with the provisions of the Certificate of Business Registration, this Charter and any licenses or permits issued by the State Agency, necessary for the business activities of the Company.

2. Each shareholder is only liable for the debts and other property obligations of the Company within the scope of the capital contributed to the Company.

Article 2. Business Name

Company name in foreign language: INTER DYNAMICS PTE. LTD

Company name in abbreviation: INTER DYNAMICS PTE

Article 3. Head office and branch and representative office addresses

Head office address: 138 Robinson RW, Road, 24-01 Oxley Tower,.Singapore.068906.

Article 4. Business lines:

|

No. |

Line name |

Line code |

Main business lines |

|

1 |

Commodity agent, broker, auction Details: Commodity agent, commodity broker |

4610 |

|

|

2 |

Wholesale of agricultural and forestry raw materials (except wood, bamboo and rattan) and live animals |

4620 |

|

|

3 |

Wholesale of rice, wheat, other cereals, flour |

4631 |

|

|

4 |

Wholesale of food |

4632 |

|

|

5 |

Beverage Wholesale Details: Wholesale of Alcoholic Beverage, Wholesale of Non-Alcoholic Beverage |

4633 |

|

|

6 |

Wholesale of solid, liquid, gaseous fuels and related products Details: Wholesale of petroleum and related products; Wholesale of gas, fuel and related products; Wholesale of lubricants, greases, liquefied petroleum gas LPG |

4661 |

x |

|

7 |

Wholesale of metals and metal ores |

4662 |

|

|

8 |

Non-specialized wholesale trade |

4690 |

|

|

9 |

Retailing of food, beverages, tobacco, and pipe tobacco accounts for a large proportion in general stores Details: Retailing of alcoholic and non-alcoholic beverages in supermarkets and convenience stores |

4711 |

|

|

10 |

Retail sale of motor fuel in specialised stores |

4730 |

|

|

11 |

Restaurants and mobile food service establishments |

5610 |

|

|

12 |

Other food services |

5629 |

|

|

13 |

Beverage services |

5630 |

|

|

14 |

Real estate business, land use rights owned, used or leased |

6810 |

|

|

15 |

Real estate consulting, brokerage, auction, land use rights auction |

6820 |

|

|

16 |

Management consulting activities Details: Consulting, guidance and assistance in business operations (excluding legal advice, accounting advice, auditing and tax advice) |

7020 |

|

|

17 |

Market research and public opinion polling |

7320 |

|

|

18 |

Leasing of non-financial intangible assets Details: franchising |

7740 |

|

|

19 |

Organization of trade introduction and promotion |

8230 |

|

|

20 |

Wholesale of other household goods Details: Wholesale of pharmaceuticals and medical equipment |

4649 |

|

|

21 |

Wholesale of other machinery, equipment and spare parts Details: wholesale of medical machinery and equipment |

4659 |

|

|

22 |

Other specialized wholesale not elsewhere classified Details: rubber wholesale, pulp wholesale, precious stones wholesale |

4669 |

|

|

23 |

Other supporting services related to transportation Details: Customs clearance and logistics agency activities |

5229 |

|

|

24 |

Short-term accommodation services Details: hotel services; guest house services; motels; short-term accommodation services |

5510 |

|

Article 5: Term of operation

The company's operating period is: 50 years from the date the business registration authority issues the business registration certificate. The company may terminate its operations before the deadline or extend its operating period according to the decision of the General Meeting of Shareholders or according to the provisions of law.

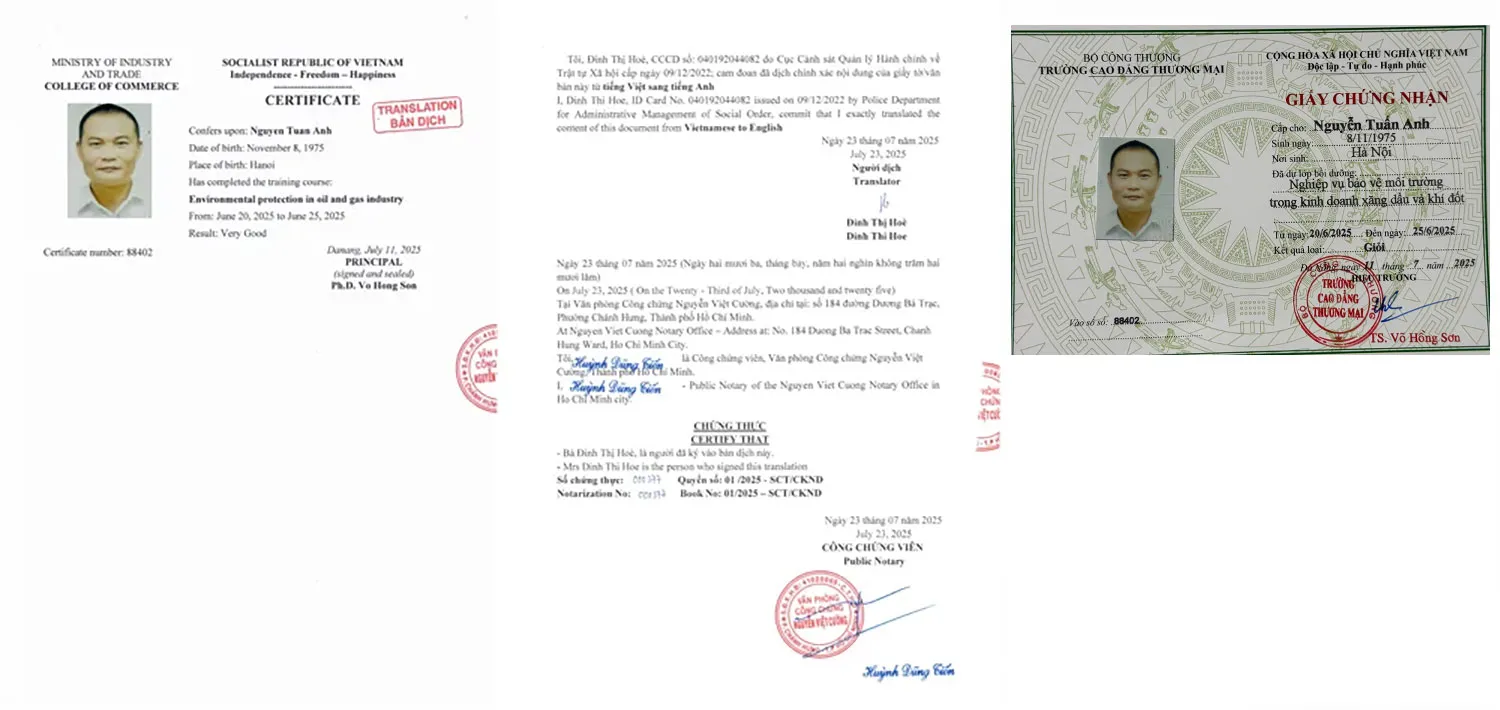

Article 6. Legal representative of the company

1. Number of legal representatives: The Company has 01 legal representative, title: Chairman of the Board of Directors and General Director

Full name of legal representative: Nguyen Tuan Anh Sex: Male

Date of birth: November 08, 1975 Ethnic group: Kinh Nationality: Vietnamese

Type of legal document: Citizen identity card

Legal document number: 001 075 000 586 Date of issue: March 21, 2023

Place of issue: Police Department for Administrative Management of Social Order

Permanent address: Room 530 A3, Giang Vo Town, Ba Dinh Province, Hanoi City

Contact address: Room 530 A3, Giang Vo Town, Ba Dinh Province, Hanoi City.

2. Rights and obligations of legal representative:

- The legal representative of an enterprise has the following responsibilities:

a) To exercise the assigned rights and obligations honestly, carefully and to the best of his/her ability to ensure the legitimate interests of the enterprise;

b) To be loyal to the interests of the enterprise; not to abuse his/her position, title and use information, know-how, business opportunities, and other assets of the enterprise for personal gain or to serve the interests of other organizations or individuals;

c) To promptly, fully and accurately notify the enterprise about his/her enterprise, his/her related persons who own or have shares or contributed capital in accordance with the provisions of the Law on Enterprises.

The legal representative of an enterprise is personally liable for damages to the enterprise due to violations of the responsibilities prescribed in Clause 3 of this Article.

Chapter 2

CAPITAL - CHARTER - SHAREHOLDERS - SHARES - STOCKS

Article 7. Charter capital and shares of founding shareholders

1. The charter capital of a joint stock company is the total par value of all types of shares sold. The charter capital of a joint stock company upon registration for establishment is the total par value of all types of shares registered for purchase and recorded in the company's charter.

- The charter capital of the company is: 200,000,000,000 VND (written in words: two hundred billion Vietnamese dong), of which:

- Total number of shares registered for purchase by founding shareholders: 20,000,000 shares

- Par value of shares: 10,000 VND (written in words: ten thousand Vietnamese dong)/01 share

Founding shareholders, number of shares, share value of each founding shareholder, capital contribution period:

|

No. |

Name of founding shareholder |

Capital contribution |

Capital contribution period |

|||||||

|

Total shares |

Rate (%) |

Type of shares |

Type of assets, quantity, value of contributed assets |

|||||||

|

Quantity |

Value |

Ordinary |

……..

|

|||||||

|

Quantity |

Value |

Quantity |

Value |

|||||||

|

1 |

NGUYEN TUAN ANH |

14,000,000 |

140,000,000,000 |

70% |

14,000,000 |

140,000,000,000 |

|

|

Vietnamese Dong |

Within 90 days from the date of issuance of the Certificate of Business Registration |

|

2 |

DO XUAN VU |

2,000,000 |

20,000,000,000 |

10% |

2,000,000 |

20, 000,000,000 |

|

|

Vietnamese Dong |

|

|

3 |

VU THI HOA |

2,000,000 |

20,000,000,000 |

10% |

2,000,000 |

20, 000,000,000 |

|

|

Vietnamese Dong |

|

|

4 |

LUONG KIM THOAI |

2,000,000 |

20,000,000,000 |

10% |

2,000,000 |

20, 000,000,000 |

|

|

Vietnamese Dong |

|

Charter capital may increase or decrease due to the Company's operational requirements and decisions of the General Meeting of Shareholders.

Article 8. Shares

1. A joint stock company must have ordinary shares. The owners of ordinary shares are common shareholders.

2. In addition to ordinary shares, a joint stock company may have preferred shares. The owners of preferred shares are called preferred shareholders. Preferred shares include the following types:

a) Voting preference shares;

b) Dividend preference shares;

c) Redeemable preference shares;

d) Other preference shares;

3. Persons entitled to purchase dividend preference shares, redeemable preference shares and other preference shares as stipulated in the Company Charter or decided by the General Meeting of Shareholders.

4. Each share of the same type shall give the owner of such shares equal rights, obligations and benefits.

5. Ordinary shares cannot be converted into preference shares. Preference shares may be converted into ordinary shares according to the resolution of the General Meeting of Shareholders.

6. Ordinary shares used as underlying assets to issue non-voting depository certificates are called underlying ordinary shares. Non-voting depository certificates have economic benefits and obligations corresponding to underlying ordinary shares, except for voting rights.

7. The Government shall prescribe non-voting depository certificates.

Article 9. Rights of Common Shareholders

1. Ordinary shareholders have the following rights:

a) To attend and speak at the General Meeting of Shareholders and to exercise their voting rights directly or through an authorized representative or in other forms as prescribed by the Company Charter or the law. Each ordinary share has one vote;

b) To receive dividends at a rate decided by the General Meeting of Shareholders;

c) To have priority in purchasing new shares corresponding to the ratio of ordinary shares owned by each shareholder in the company;

d) To freely transfer their shares to others, except in the cases prescribed in Clause 3, Article 120, Clause 1, Article 127 of the Law on Enterprises and other relevant provisions of law;

d) To review, look up and extract information about the names and contact addresses in the list of shareholders with voting rights; to request correction of inaccurate information;

e) To review, look up, extract or photocopy the Company Charter, minutes of the General Meeting of Shareholders and resolutions of the General Meeting of Shareholders;

g) When the company is dissolved or bankrupt, receive a portion of the remaining assets corresponding to the percentage of shares owned in the company.

2. Shareholders or groups of shareholders owning 05% or more of the total number of ordinary shares have the following rights:

a) To review, look up, extract the minutes and resolutions, decisions of the Board of Directors, mid-year and annual financial reports, reports of the Board of Supervisors, contracts, transactions that must be approved by the Board of Directors and other documents, except for documents related to trade secrets, business secrets of the company;

b) To request to convene a meeting of the General Meeting of Shareholders in the cases specified in Clause 3 of this Article;

c) To request the Board of Supervisors to inspect each specific issue related to the management and operation of the company when deemed necessary. The request must be in writing and must include the following contents: full name, contact address, nationality, legal document number of the individual for individual shareholders; name, enterprise code or legal document number of the organization, head office address for organizational shareholders; number of shares and time of share registration of each shareholder, total number of shares of the group of shareholders and ownership ratio in the total number of shares of the company; issues to be inspected, purpose of inspection;

d) Other rights as prescribed by the Law on Enterprises and the Company Charter.

3. A shareholder or group of shareholders specified in Clause 2 of this Article has the right to request the convening of a meeting of the General Meeting of Shareholders in the following cases:

a) The Board of Directors seriously violates the rights of shareholders, the obligations of managers or makes decisions beyond its assigned authority;

b) Other cases as prescribed in the Company Charter.

4. The request to call a meeting of the General Meeting of Shareholders specified in Clause 3 of this Article must be in writing and must include the following contents: full name, contact address, nationality, legal document number of the individual for individual shareholders; name, enterprise code or legal document number of the organization, head office address for institutional shareholders; number of shares and time of share registration of each shareholder, total number of shares of the group of shareholders and ownership ratio in the total number of shares of the company, basis and reason for requesting the convening of a meeting of the General Meeting of Shareholders. The request to convene a meeting must be accompanied by documents and evidence of the violations of the Board of Directors, the level of violations or decisions beyond its authority.

5. Shareholders or groups of shareholders owning 10% or more of the total number of ordinary shares have the right to nominate people to the Board of Directors and the Supervisory Board. The nomination of people to the Board of Directors and the Supervisory Board is carried out as follows:

a) Common shareholders forming a group to nominate people to the Board of Directors and the Supervisory Board must notify the shareholders attending the meeting of the group formation before the opening of the General Meeting of Shareholders;

b) Based on the number of members of the Board of Directors and the Supervisory Board, the shareholder or group of shareholders specified in this clause has the right to nominate one or several people according to the decision of the General Meeting of Shareholders as candidates for the Board of Directors and the Supervisory Board. In case the number of candidates nominated by a shareholder or group of shareholders is lower than the number of candidates they are entitled to nominate according to the decision of the General Meeting of Shareholders, the remaining candidates shall be nominated by the Board of Directors, the Supervisory Board and other shareholders.

6. Other rights as prescribed by the Law on Enterprises and the Company Charter.

Article 10. Obligations of common shareholders

1. Pay in full the number of shares committed to be purchased within ninety days from the date the company is granted the Certificate of Business Registration; be responsible for the debts and other property obligations of the company within the scope of the capital contributed to the company.

2. Not to withdraw the capital contributed in the form of ordinary shares from the company in any form, except in the case of the company or another person buying back the shares. In case a shareholder withdraws part or all of the contributed capital contrary to the provisions of this clause, that shareholder and the members of the Board of Directors and the legal representative of the company shall be jointly responsible for the debts and other property obligations of the company within the scope of the value of the withdrawn shares and any damages that occur.

3. Comply with the Company Charter and the internal management regulations of the company.

4. Comply with the resolutions and decisions of the General Meeting of Shareholders and the Board of Directors.

5. Keep confidential the information provided by the company according to the provisions of the Company Charter and the law; only use the information provided to exercise and protect their legitimate rights and interests; strictly prohibit the dissemination or copying or sending of information provided by the company to other organizations or individuals.

6. Ordinary shareholders shall be personally liable when performing one of the following acts on behalf of the company in any form:

a) Violating the law;

b) Conducting business and other transactions for personal gain or to serve the interests of other organizations or individuals;

c) Paying debts that have not yet matured in the face of possible financial risks to the company.

7. Other obligations as prescribed by the Law on Enterprises and the Company Charter.

Article 11: Ordinary shares of founding shareholders

1. Founding shareholders must jointly register to purchase at least 20% of the total number of ordinary shares that are eligible for sale and must fully pay for the registered shares within ninety days from the date the company is granted the Business Registration Certificate.

2. Within ninety days from the date of issuance of the Business Registration Certificate, the company must notify the business registration authority of the capital contribution. The legal representative of the company shall be personally liable for any damage to the company and others due to late notification or dishonest, inaccurate, or incomplete notification.

3. In case a founding shareholder fails to fully pay for the registered shares, the uncontributed shares of the founding shareholder shall be handled in one of the following ways:

a) The remaining founding shareholders fully contribute those shares according to their share ownership ratio in the company;

b) One or several founding shareholders accept to contribute the full amount of shares;

c) Mobilize other people who are not founding shareholders to contribute the full amount of shares; the person receiving the capital contribution naturally becomes a founding shareholder of the company. In this case, the founding shareholder who has not contributed the shares as registered is naturally no longer a shareholder of the company. When the number of shares registered to be contributed by the founding shareholders has not been fully contributed, the founding shareholders shall be jointly responsible for the debts and other financial obligations of the company within the value of the shares not yet fully contributed.

4. In case the founding shareholders do not register to purchase all the shares offered for sale, the remaining shares must be offered for sale and sold within three years from the date the company is granted the Certificate of Business Registration.

5. Within three years from the date the company is granted the Certificate of Business Registration, founding shareholders have the right to freely transfer their ordinary shares to other founding shareholders, but may only transfer their ordinary shares to persons who are not founding shareholders with the approval of the General Meeting of Shareholders. In this case, the shareholder intending to transfer shares does not have the right to vote on the transfer of such shares and the transferee automatically becomes a founding shareholder of the company. After three years from the date the company is granted the Certificate of Business Registration, all restrictions on ordinary shares of founding shareholders are abolished.

Article 12: Voting preference shares and rights of shareholders owning voting preference shares

1. Voting preference shares are ordinary shares with more votes than other ordinary shares; the number of votes of a voting preference share is: 2/1.

2. Only founding shareholders are entitled to hold voting preference shares. The voting preference of founding shareholders is valid for 03 years from the date the company is granted the Certificate of Business Registration. After the voting preference period, voting preference shares are converted into ordinary shares.

3. Shareholders owning voting preference shares have the following rights:

a) To vote on matters within the competence of the General Meeting of Shareholders with the number of votes as prescribed in Clause 1 of this Article;

b) Other rights as common shareholders, except for the case prescribed in Clause 4 of this Article.

4. Shareholders owning voting preference shares may not transfer such shares to others, except in cases of transfer pursuant to a legally effective court judgment or decision or inheritance.

Article 13: Dividend preference shares and rights of shareholders owning dividend preference shares

1. Dividend preference shares are shares that pay dividends at a higher rate than the dividend rate of ordinary shares or at a stable annual rate. Dividends paid annually include fixed dividends and bonus dividends. Fixed dividends do not depend on the company's business results. The specific fixed dividend rate and the method of determining bonus dividends are clearly stated in the dividend preference shares.

2. Shareholders owning dividend preference shares have the following rights:

a) Receive dividends according to the provisions of Clause 1 of this Article;

b) Receive the remaining assets corresponding to the ratio of shares owned in the company after the company has paid all debts and redeemed preference shares when the company is dissolved or bankrupt;

c) Other rights as common shareholders, except for the cases specified in Clause 3 of this Article.

3. Shareholders owning dividend preference shares do not have the right to vote, attend the General Meeting of Shareholders, nominate people to the Board of Directors and the Board of Supervisors, except in the case specified in Clause 6, Article 148 of the Law on Enterprises.

Article 14. Redeemable preference shares and rights of shareholders owning redeemable preference shares

1. Redeemable preference shares are shares whose capital contribution is refunded by the company upon the request of the owner or under the conditions stated in the redeemable preference shares and the Company Charter.

2. Shareholders owning redeemable preference shares have the same rights as ordinary shareholders, except for the cases specified in Clause 3 of this Article.

3. Shareholders owning redeemable preference shares do not have the right to vote, attend the General Meeting of Shareholders, or nominate candidates for the Board of Directors and the Supervisory Board, except for the cases specified in Clause 5, Article 114 and Clause 6, Article 148 of the Law on Enterprises.

Article 15. Shares

1. A share is a certificate issued by a joint stock company, a book entry or electronic data confirming ownership of one or more shares of that company. There are two types of shares: registered shares and bearer shares.

A share must include the following main contents:

a) Name, enterprise code, head office address of the company;

b) Number of shares and type of shares;

c) Par value of each share and total par value of shares recorded on the share;

d) Full name, contact address, nationality, legal document number of the individual for individual shareholders; name, enterprise code or legal document number of the organization, head office address for institutional shareholders;

d) Signature of the legal representative of the company;

e) Registration number in the company's shareholder register and date of issuance of the share;

g) Other contents as prescribed in Articles 116, 117 and 118 of the Enterprise Law for shares of preferred shares.

2. In case of errors in the content and form of shares issued by the company, the rights and interests of the owner of such shares shall not be affected. The legal representative of the company shall be responsible for damages caused by such errors.

3. In case of shares being lost, damaged or destroyed in other forms, the shareholder shall be reissued shares by the company upon the request of that shareholder. The request of the shareholder must include the following contents:

a) Information about the shares that have been lost, damaged or destroyed in other forms;

b) Commitment to take responsibility for disputes arising from the reissuance of new shares.

For shares with a nominal value of over ten million Vietnamese Dong, before accepting a request for issuance of new shares, the company's legal representative may request the owner of the shares to post a notice of loss, burning or other destruction of the shares and, after fifteen days from the date of posting the notice, request the company to issue new shares.

Article 16. Shareholder register

1. A joint stock company must establish and maintain a shareholder register from the date of issuance of the Certificate of Business Registration. The shareholder register may be a paper document or an electronic data set recording information on the ownership of shares of the company's shareholders.

2. The shareholder register must include the following main contents:

a) Name and head office address of the company;

b) Total number of shares authorized to be offered for sale, types of shares authorized to be offered for sale and number of shares authorized to be offered for sale of each type;

c) Total number of shares sold of each type and value of contributed capital;

d) Full name, contact address, nationality, legal document number of the individual for individual shareholders; name, enterprise code or legal document number of the organization, head office address for organizational shareholders;

d) Number of shares of each type of each shareholder, date of share registration.

3. The shareholder register is kept at the company's head office or the Securities Registration, Depository, Clearing and Payment Center. Shareholders have the right to inspect, look up, extract, and copy the contents of the shareholder register during the working hours of the company or the Securities Registration, Depository, Clearing and Payment Center.

4. In case a shareholder changes his/her contact address, he/she must promptly notify the company to update the shareholder register. The company is not responsible for not being able to contact the shareholder due to not being notified of the change in the shareholder's contact address.

5. The company must promptly update changes in shareholders in the shareholder register upon request of the relevant shareholder as prescribed in the Company Charter.

Article 17: Offering of shares

1. Offering shares is the act of a company increasing the number of shares it is entitled to offer and selling those shares during its operations to increase its charter capital.

2. Offering shares can be done in one of the following forms:

a) Offering to existing shareholders;

b) Offering to the public;

c) Offering individual shares.

3. Offering shares to the public, offering shares of listed and public joint stock companies shall comply with the provisions of the law on securities.

4. The company shall register changes to its charter capital within 10 days from the date of completion of the share offering.

Article 18: Transfer of shares

1. Shares are freely transferable, except in the case specified in Clause 3, Article 120 of the Law on Enterprises and the Company Charter, which stipulates restrictions on the transfer of shares. In case the Company Charter stipulates restrictions on the transfer of shares, these provisions shall only be effective when clearly stated in the certificates of the corresponding shares.

2. The transfer shall be carried out by contract or transaction on the stock market. In case of transfer by contract, the transfer documents must be signed by the transferor and the transferee or their authorized representatives. In case of transaction on the stock market, the transfer procedures shall be carried out in accordance with the provisions of the law on securities.

3. In case an individual shareholder dies, the heir according to the will or according to the law of that shareholder shall become a shareholder of the company.

4. In case a shareholder is an individual who dies without an heir, the heir refuses to receive the inheritance or is deprived of the right to inherit, the number of shares of that shareholder shall be resolved in accordance with the provisions of the civil law.

5. Shareholders have the right to donate part or all of their shares in the company to other individuals or organizations; use shares to pay debts. Individuals and organizations that receive shares or receive debt payment in the form of shares shall become shareholders of the company.

6. Individuals and organizations that receive shares in the cases specified in this Article shall only become shareholders of the company from the time their information specified in Clause 2, Article 122 of the Law on Enterprises is fully recorded in the shareholder register.

7. The company must register changes in shareholders in the shareholder register at the request of the relevant shareholder within 24 hours from the time of receiving the request as prescribed in the Company Charter.

Article 19: Payment for shares registered for purchase upon business registration

1. Shareholders must pay in full for the registered shares within 90 days from the date of issuance of the Certificate of Business Registration, unless the Company Charter or the share registration contract stipulates a shorter period. In case shareholders contribute capital in the form of assets, the time for transporting, importing, and carrying out administrative procedures to transfer ownership of such assets shall not be included in this capital contribution period. The Board of Directors shall be responsible for supervising and urging shareholders to pay in full and on time for the registered shares.

2. Within the period from the date the company is issued the Certificate of Business Registration to the last day for full payment of the registered shares as prescribed in Clause 1 of this Article, the number of votes of shareholders shall be calculated according to the number of ordinary shares registered for purchase.

3. In case after the deadline specified in Clause 1 of this Article, a shareholder has not paid or has only paid a part of the registered shares, the following provisions shall apply:

a) A shareholder who has not paid for the registered shares is automatically no longer a shareholder of the company and is not allowed to transfer the right to purchase such shares to another person;

b) A shareholder who has only paid a part of the registered shares has the right to vote, receive dividends and other rights corresponding to the paid shares; and is not allowed to transfer the right to purchase unpaid shares to another person;

c) Unpaid shares are considered unsold shares and the Board of Directors has the right to sell them;

d) Within 30 days from the end of the deadline for full payment of the registered shares as prescribed in Clause 1 of this Article, the company must register to adjust the charter capital by the par value of the fully paid shares, except in cases where the unpaid shares have been sold out within this period; Registering changes in founding shareholders.

4. Shareholders who have not paid or have not fully paid for the registered shares shall be liable for the total par value of the registered shares for the financial obligations of the company arising within the period before the date the company registers to adjust its charter capital as prescribed in Point d, Clause 3 of this Article. Members of the Board of Directors and legal representatives shall be jointly liable for damages arising from failure to comply or failure to comply with the provisions in Clause 1 and Point d, Clause 3 of this Article.

5. Except for the case prescribed in Clause 2 of this Article, capital contributors shall become shareholders of the company from the time they have paid for the purchase of shares and the information about shareholders prescribed in Points b, c, d and dd, Clause 2, Article 122 of the Law on Enterprises shall be recorded in the shareholder register.

Article 20: Purchase of shares and bonds

Shares and bonds of a joint stock company can be purchased with Vietnamese Dong, freely convertible foreign currency, gold, land use rights, intellectual property rights, technology, technical know-how, other assets and must be paid in full at one time.

Article 21: Repurchase of shares at the request of shareholders

1. Shareholders who have voted not to pass a resolution on the reorganization of the company or change the rights and obligations of shareholders as stipulated in the Company Charter have the right to request the Company to buy back their shares. The request must be in writing, clearly stating the name and address of the shareholder, the number of shares of each type, the intended selling price, and the reason for requesting the Company to buy back. The request must be sent to the Company within 10 days from the date the General Meeting of Shareholders passes a resolution on the matters stipulated in this Clause.

2. The Company must buy back shares at the request of the shareholder as stipulated in Clause 1 of this Article at the market price or the price calculated according to the principles stipulated in the Company Charter within 90 days from the date of receipt of the request. In case of failure to reach an agreement on the price, the parties may request a valuation organization to determine the price. The Company shall introduce at least 03 valuation organizations for the shareholder to choose from, and that choice shall be the final decision.

Article 22: Share repurchase according to the Company's decision

The Company has the right to repurchase no more than 30% of the total number of ordinary shares sold, part or all of the dividend preference shares sold according to the following provisions:

1. The Board of Directors has the right to decide to buy back no more than 10% of the total number of shares of each type offered for sale in each twelve months. In other cases, the purchase of shares shall be decided by the General Meeting of Shareholders;

2. The Board of Directors shall decide on the purchase price of shares. For ordinary shares, the purchase price shall not be higher than the market price at the time of purchase, except for the case specified in Clause 3 of this Article. For other types of shares, if the company and the relevant shareholders do not have another agreement, the purchase price shall not be lower than the market price;

3. The Company may repurchase shares of each shareholder corresponding to their shareholding ratio in the Company. The decision to repurchase shares of the company must be notified by guaranteed means to all shareholders within thirty days from the date of such decision. Shareholders who agree to resell shares must send their offer to the company by guaranteed means within thirty days from the date of notification. The company will only repurchase shares offered for sale within the above-mentioned period.

Article 23: Terms of payment and handling of repurchased shares

1. The Company shall only pay for the shares repurchased to shareholders as prescribed in Articles 21 and 22 of this Charter if, immediately after paying for all the shares repurchased, the Company still ensures full payment of all debts and other financial obligations.

2. Shares repurchased as prescribed in Articles 21 and 22 of this Charter shall be considered unsold shares as prescribed in Clause 4, Article 112 of the Law on Enterprises. The Company shall register a reduction in charter capital corresponding to the total par value of the shares repurchased by the Company within 10 days from the date of completion of the payment for the repurchase of shares, unless otherwise provided by the law on securities.

3. Shares confirming ownership of the shares repurchased must be destroyed immediately after the corresponding shares have been fully paid. The Chairman of the Board of Directors and the Director (General Director) shall be jointly liable for any damage caused to the company by failure to destroy or delay in destroying the shares.

4. After the full payment of the repurchased shares, if the total value of assets recorded in the company's accounting books decreases by more than 10%, the company must notify all creditors within fifteen days from the date of full payment of the repurchased shares.

Article 24: Dividend payment

1. Dividends paid for preferred shares are made according to the conditions applicable to each type of preferred shares.

2. Dividends paid for ordinary shares are determined based on the net profit realized and the dividend payment is deducted from the company's retained earnings. A joint stock company may only pay dividends on ordinary shares when all of the following conditions are met:

a) The company has fulfilled its tax obligations and other financial obligations as prescribed by law;

b) The company has set aside funds and compensated for previous losses as prescribed by law and the company's charter;

c) Immediately after paying all dividends, the company still ensures full payment of debts and other financial obligations due.

3. Dividends may be paid in cash, in shares of the company or in other assets as prescribed in the company's charter. If payment is made in cash, it must be made in Vietnamese Dong and in accordance with the payment methods prescribed by law.

4. Dividends must be paid in full within 06 months from the date of closing of the Annual General Meeting of Shareholders. The Board of Directors shall prepare a list of shareholders entitled to receive dividends, determine the dividend amount paid for each share, the time limit and form of payment at least 30 days before each dividend payment. Notice of dividend payment shall be sent by a method to ensure that it reaches the shareholders at the registered address in the shareholder register at least 15 days before the dividend payment. The notice must include the following contents:

a) Company name and head office address of the company;

b) Full name, contact address, nationality, legal document number of the individual for individual shareholders;

c) Name, enterprise code or legal document number of the organization, head office address for institutional shareholders;

d) Number of shares of each type of shareholder; dividend rate for each share and total dividend that the shareholder is entitled to receive;

d) Time and method of dividend payment;

e) Full name and signature of the Chairman of the Board of Directors and the legal representative of the company.

5. In case a shareholder transfers his/her shares between the time of completion of the shareholder list and the time of dividend payment, the transferor shall be the person receiving the dividend from the company.

6. In case of payment of dividends in shares, the company does not have to carry out procedures for offering shares for sale as prescribed in Articles 123, 124 and 125 of the Law on Enterprises. The company must register to increase its charter capital corresponding to the total par value of the shares used to pay dividends within 10 days from the date of completion of dividend payment.

Article 25: Recovery of payment for repurchased shares or dividends

In case the payment for repurchased shares is contrary to the provisions of Clause 1, Article 134 of the Law on Enterprises or the payment of dividends is contrary to the provisions of Article 135 of the Law on Enterprises, the shareholder must return to the company the amount of money or other assets received; in case the shareholder cannot return to the company, all members of the Board of Directors must jointly be responsible for the debts and other property obligations of the company within the value of the amount of money or assets paid to the shareholder but not yet returned.

CHAPTER 3

COMPANY ORGANIZATIONAL STRUCTURE

Article 26: Organizational structure of joint stock company management

The organizational structure of company management includes:

- General Meeting of Shareholders;

- Board of Directors;

- Director (or General Director);

- Board of Supervisors (if any).

Article 27: General meeting of shareholders

1. The General Meeting of Shareholders, comprising all shareholders with voting rights, is the highest decision-making body of the Joint Stock Company.

2. The General Meeting of Shareholders has the following rights and obligations:

a) Approving the development orientation of the company;

b) Deciding on the types of shares and the total number of shares of each type that are allowed to be offered for sale; deciding on the annual dividend rate for each type of shares;

c) Electing, dismissing, and removing members of the Board of Directors and Supervisors;

d) Deciding on investing or selling assets with a value of 35% or more of the total value of assets recorded in the company's most recent financial statements, unless the Company Charter stipulates a different ratio or value;

d) Deciding on amending and supplementing the Company Charter;

e) Approving the annual financial statements;

g) Deciding on repurchasing more than 10% of the total number of shares sold of each type;

h) Reviewing and handling violations by members of the Board of Directors and Supervisors that cause damage to the company and its shareholders;

i) Deciding on the reorganization and dissolution of the company;

k) Deciding on the budget or total remuneration, bonuses and other benefits for the Board of Directors and Supervisory Board;

l) Approving the internal governance regulations; regulations on the operation of the Board of Directors and Supervisory Board;

m) Approving the list of independent auditing companies; decide on independent auditing companies to conduct inspections of the company's operations, and dismiss independent auditors when deemed necessary;

n) Other rights and obligations as prescribed by this Law and the Company Charter.

Article 28: Board of Directors

1. The Board of Directors is the company's management body, with full authority to decide and exercise the company's rights and obligations on behalf of the company, except for the rights and obligations under the authority of the General Meeting of Shareholders.

2. The Board of Directors has the following rights and obligations:

a) Deciding on the company's strategy, medium-term development plan and annual business plan;

b) Proposing the type of shares and the total number of shares that can be offered for sale of each type;

c) Deciding on the sale of unsold shares within the number of shares that can be offered for sale of each type; deciding on raising additional capital in other forms;

d) Deciding on the selling price of the company's shares and bonds;

d) Deciding on the repurchase of shares in accordance with the provisions of Clause 1 and Clause 2, Article 133 of the Law on Enterprises;

e) Deciding on investment plans and investment projects within the authority and limits prescribed by law;

g) Deciding on solutions for market development, marketing and technology;

h) Approving contracts for purchase, sale, borrowing, lending and other contracts and transactions with a value of 35% or more of the total asset value recorded in the company's most recent financial report, except in cases where the company's charter stipulates a different ratio or value and the contract or transaction falls under the decision-making authority of the General Meeting of Shareholders as prescribed in Point d, Clause 2, Article 138, Clauses 1 and 3, Article 167 of the Law on Enterprises;

i) Electing, dismissing, removing the Chairman of the Board of Directors; appointing, dismissing, signing contracts, terminating contracts with the Director or General Director and other important managers as prescribed in the company's charter; deciding on salaries, remuneration, bonuses and other benefits of such managers; appointing authorized representatives to participate in the Board of Members or General Meeting of Shareholders of other companies, deciding on the remuneration and other benefits of those persons;

k) Supervising and directing the Director or General Director and other managers in the daily business operations of the company;

l) Deciding on the organizational structure, internal management regulations of the company, deciding on the establishment of subsidiaries, branches, representative offices and capital contribution, purchase of shares of other enterprises;

m) Approving the program, content of documents serving the General Meeting of Shareholders, convening the General Meeting of Shareholders or collecting opinions for the General Meeting of Shareholders to pass resolutions;

n) Submitting annual financial reports to the General Meeting of Shareholders;

o) Proposing the dividend level to be paid; deciding on the time limit and procedures for paying dividends or handling losses arising during the business process;

p) Proposing the reorganization and dissolution of the company; requesting the bankruptcy of the company;

q) Other rights and obligations as prescribed by this Law and the Company Charter.

3. The Board of Directors shall pass resolutions and decisions by voting at meetings, collecting written opinions or other forms as prescribed by the Company Charter. Each member of the Board of Directors shall have one vote.

4. In case a resolution or decision passed by the Board of Directors is contrary to the provisions of law, resolutions of the General Meeting of Shareholders, or the Company Charter, causing damage to the Company, the members who agree to pass such resolution or decision shall be jointly and severally liable for such resolution or decision and shall compensate the Company for such damage; members who oppose the passage of the above resolution or decision shall be exempted from liability. In this case, the Company's shareholders shall have the right to request the Court to suspend or annul the implementation of the above resolution or decision.

Article 29: Chairman of the Board of Directors

1. The Chairman of the Board of Directors is elected, dismissed, or removed from among the members of the Board of Directors by the Board of Directors.

2. The Chairman of the Board of Directors of a public company or a joint stock company specified in Point b, Clause 1, Article 88 of the Law on Enterprises shall not concurrently be the Director or General Director.

3. The Chairman of the Board of Directors shall have the following rights and obligations:

a) Prepare the program and plan of activities of the Board of Directors;

b) Prepare the program, content, and documents for meetings; convene, chair, and preside over meetings of the Board of Directors;

c) Organize the adoption of resolutions and decisions of the Board of Directors;

d) Supervise the implementation of resolutions and decisions of the Board of Directors;

d) Chair the General Meeting of Shareholders.

4. In case the Chairman of the Board of Directors is absent or unable to perform his/her duties, he/she must authorize in writing another member to exercise the rights and obligations of the Chairman of the Board of Directors in accordance with the principles prescribed in the Company Charter. In case there is no authorized person or the Chairman of the Board of Directors dies, goes missing, is detained, is serving a prison sentence, is serving an administrative penalty at a compulsory drug rehabilitation facility, a compulsory education facility, has fled from his/her place of residence, has limited or lost civil capacity, has difficulty in cognition, controlling his/her behavior, is prohibited by the Court from holding a position, practicing a profession or doing certain work, the remaining members shall elect one of the members to hold the position of Chairman of the Board of Directors according to the principle of majority approval of the remaining members until a new decision of the Board of Directors is made.

5. When deemed necessary, the Board of Directors shall decide to appoint a company secretary. The company secretary has the following rights and obligations:

a) Assisting in organizing the convening of meetings of the General Meeting of Shareholders and the Board of Directors; recording meeting minutes;

b) Assisting members of the Board of Directors in exercising their assigned rights and obligations;

c) Assisting the Board of Directors in applying and implementing corporate governance principles;

d) Assisting the company in building shareholder relations and protecting the legitimate rights and interests of shareholders; complying with the obligation to provide information, publicize information and administrative procedures.

Article 30: Director (General Director)

1. The Board of Directors appoints a member of the Board of Directors or hires another person to be the Director or General Director.

2. The Director or General Director is the person who runs the daily business of the company; is supervised by the Board of Directors; is responsible to the Board of Directors and before the law for the implementation of assigned rights and obligations. The term of office of the Director or General Director shall not exceed 05 years and may be reappointed for an unlimited number of terms.

3. The Director or General Director has the following rights and obligations:

a) Decide on matters related to the daily business of the company that are not under the authority of the Board of Directors;

b) Organize the implementation of resolutions and decisions of the Board of Directors;

c) Organize the implementation of the company's business plan and investment plan;

d) Propose the organizational structure plan and internal management regulations of the company;

d) Appoint, dismiss, and remove management positions in the company, except for positions under the authority of the Board of Directors;

e) Decide on salaries and other benefits for employees in the company, including managers under the appointment authority of the Director or General Director;

g) Recruit employees;

h) Propose plans to pay dividends or handle business losses;

i) Other rights and obligations as prescribed by law, the Company Charter and resolutions and decisions of the Board of Directors.

4. The Director or General Director must manage the daily business of the company in accordance with the provisions of law, the Company Charter, the labor contract signed with the company and the resolutions and decisions of the Board of Directors. In case of management contrary to the provisions of this clause causing damage to the company, the Director or General Director shall be responsible before the law and must compensate the company for the damage.

5. For public companies, state-owned enterprises as prescribed in Point b, Clause 1, Article 88 of the Law on Enterprises and subsidiaries of state-owned enterprises as prescribed in Clause 1, Article 88 of the Law on Enterprises, the Director or General Director must meet the following standards and conditions:

a) Not being subject to the provisions of Clause 2, Article 17 of the Law on Enterprises;

b) Not being a relative of the enterprise manager, Controller of the company and parent company; representative of state capital, representative of enterprise capital at the company and parent company;

c) Having professional qualifications and experience in business administration of the company.

Article 31: Salary, remuneration, bonus and other benefits of members of the Board of Directors, Director, General Director

1. The Company has the right to pay remuneration and bonuses to members of the Board of Directors, pay salaries and bonuses to the Director or General Director and other managers based on business results and efficiency.

2. Unless otherwise provided for in the Company Charter, salaries, remuneration, bonuses and other benefits of members of the Board of Directors, Director or General Director shall be paid according to the following provisions:

a) Members of the Board of Directors shall receive remuneration for work and bonuses. Remuneration for work shall be calculated based on the number of working days required to complete the duties of the Board of Directors member and the daily remuneration. The Board of Directors shall estimate the remuneration for each member based on the principle of consensus. The total remuneration and bonuses of the Board of Directors shall be decided by the General Meeting of Shareholders at the annual meeting;

b) Members of the Board of Directors shall be paid for meals, accommodation, travel and other reasonable expenses when performing assigned tasks;

c) The Director or General Director shall be paid salary and bonuses. The salary and bonus of the Director or General Director shall be decided by the Board of Directors. 3. The remuneration of each member of the Board of Directors, the salary of the Director or General Director and other managers shall be included in the company's business expenses in accordance with the provisions of the law on corporate income tax, shall be shown as a separate item in the company's annual financial statements and shall be reported to the General Meeting of Shareholders at the annual meeting.

Article 32: Responsibilities of company managers

1. Members of the Board of Directors, the Director or General Director and other managers have the following responsibilities:

a) Exercise the rights and obligations assigned according to the provisions of the Law on Enterprises, other provisions of relevant laws, the Company Charter, resolutions of the General Meeting of Shareholders;

b) Exercise the rights and obligations assigned honestly, carefully and to the best of their ability to ensure the maximum legitimate interests of the company;

c) Be loyal to the interests of the company and shareholders; do not abuse their position, title and use information, secrets, business opportunities, and other assets of the company for personal gain or to serve the interests of other organizations and individuals;

d) Timely, fully and accurately notify the company of the contents specified in Clause 2, Article 164 of the Law on Enterprises;

d) Other responsibilities as prescribed by the Law on Enterprises and the Company Charter.

2. Members of the Board of Directors, Directors or General Directors and other managers who violate the provisions of Clause 1 of this Article shall be personally or jointly responsible for compensating for lost benefits, returning received benefits and fully compensating for damages to the company and third parties.

Article 33: Authority to convene the General Meeting of Shareholders

1. The General Meeting of Shareholders shall convene once a year. In addition to the annual meeting, the General Meeting of Shareholders may convene an extraordinary meeting. The location of the General Meeting of Shareholders shall be determined as the place where the chair attends the meeting and must be within the territory of Vietnam.

2. The General Meeting of Shareholders shall convene annually within 04 months from the end of the fiscal year. Unless otherwise provided in the Company Charter, the Board of Directors shall decide to extend the annual General Meeting of Shareholders if necessary, but not exceeding 06 months from the end of the fiscal year.

3. The annual General Meeting of Shareholders shall discuss and approve the following matters:

a) The company's annual business plan;

b) Annual financial statements;

c) Report of the Board of Directors on the management and performance of the Board of Directors and each member of the Board of Directors;

d) Report of the Board of Supervisors on the company's business results, the performance of the Board of Directors, Director or General Director;

d) Self-assessment report on the performance of the Board of Supervisors and Supervisors;

e) Dividend level for each share of each type;

g) Other matters within its competence.

4. The Board of Directors convenes annual and extraordinary General Meetings of Shareholders. The Board of Directors convenes extraordinary General Meetings of Shareholders in the following cases:

a) The Board of Directors considers it necessary for the benefit of the company;

b) The number of remaining members of the Board of Directors and the Board of Supervisors is less than the minimum number of members as prescribed by law;

c) At the request of a shareholder or group of shareholders as prescribed in Clause 2, Article 115 of the Law on Enterprises;

d) At the request of the Board of Supervisors;

d) Other cases as prescribed by law and the Company Charter.

5. Unless otherwise provided in the Company Charter, the Board of Directors must convene a General Meeting of Shareholders within 30 days from the date of occurrence of the case specified in Point b, Clause 4 of this Article or from receipt of a request to convene a meeting specified in Point c and Point d, Clause 4 of this Article. In case the Board of Directors fails to convene a General Meeting of Shareholders as prescribed, the Chairman of the Board of Directors and members of the Board of Directors must compensate for any damage incurred to the company.

6. In case the Board of Directors fails to convene a General Meeting of Shareholders as prescribed in Clause 5 of this Article, within the next 30 days, the Supervisory Board shall replace the Board of Directors in convening a General Meeting of Shareholders as prescribed by the Law on Enterprises. In case the Supervisory Board fails to convene a General Meeting of Shareholders as prescribed, the Supervisory Board must compensate for any damage incurred to the company.

7. In case the Board of Supervisors does not convene the General Meeting of Shareholders as prescribed in Clause 6 of this Article, the shareholder or group of shareholders as prescribed in Clause 2, Article 115 of the Law on Enterprises shall have the right to represent the company to convene the General Meeting of Shareholders as prescribed in the Law on Enterprises.

8. The person convening the General Meeting of Shareholders must perform the following tasks:

a) Prepare a list of shareholders entitled to attend the meeting;

b) Provide information and resolve complaints related to the list of shareholders;

c) Prepare the agenda and content of the meeting;

d) Prepare documents for the meeting;

d) Draft resolutions of the General Meeting of Shareholders according to the expected content of the meeting; list and detailed information of candidates in case of election of members of the Board of Directors and Supervisors;

e) Determine the time and location of the meeting;

g) Send a notice of invitation to each shareholder entitled to attend the meeting as prescribed in this Law;

h) Other work serving the meeting.

9. The costs of convening and conducting the General Meeting of Shareholders as prescribed in Clauses 4, 5, 6 of this Article shall be reimbursed by the company.

Article 34: Conditions for holding a General Meeting of Shareholders

1. The General Meeting of Shareholders shall be held when the number of shareholders attending the meeting represents more than 50% of the total number of voting rights;

2. In case the first meeting does not meet the conditions for holding the meeting as prescribed in Clause 1 of this Article, the notice of invitation to the second meeting must be sent within 30 days from the date of the first meeting, unless otherwise provided in the Company Charter. The second General Meeting of Shareholders shall be held when the number of shareholders attending the meeting represents 33% or more of the total number of voting rights; the specific ratio shall be provided in the Company Charter.

3. In case the second meeting does not meet the conditions for holding the meeting as prescribed in Clause 2 of this Article, the notice of invitation to the third meeting must be sent within 20 days from the date of the second meeting, unless otherwise provided in the Company Charter. The third General Meeting of Shareholders shall be held regardless of the total number of voting rights of the shareholders attending the meeting.

4. Only the General Meeting of Shareholders has the right to decide to change the meeting agenda sent with the meeting invitation as prescribed in Article 142 of the Law on Enterprises.

Article 35: Procedures for conducting meetings and voting at the General Meeting of Shareholders

The procedures for conducting meetings and voting at the General Meeting of Shareholders shall be as follows:

1. Before opening the meeting, shareholders attending the General Meeting of Shareholders must be registered;

2. The election of the chairman, secretary and vote counting committee shall be regulated as follows:

a) The Chairman of the Board of Directors shall chair or authorize another member of the Board of Directors to chair the General Meeting of Shareholders convened by the Board of Directors; in case the Chairman is absent or

temporarily incapable of working, the remaining members of the Board of Directors shall elect one of them to chair the meeting according to the majority principle; In case no one can be elected as the chairperson, the Head of the Supervisory Board shall direct the General Meeting of Shareholders to elect the chairperson of the meeting and the person with the highest number of votes shall chair the meeting;

b) Except for the case specified in Point a of this Clause, the person who signs the meeting of the General Meeting of Shareholders shall direct the General Meeting of Shareholders to elect the chairperson of the meeting and the person with the highest number of votes shall chair the meeting;

c) The chairperson shall appoint one or several persons to act as the meeting secretary;

d) The General Meeting of Shareholders shall elect one or several persons to the vote counting committee upon the request of the chairperson of the meeting;

3. The agenda and content of the meeting must be approved by the General Meeting of Shareholders in the opening session. The agenda must specify the time for each issue in the agenda;

4. The chairperson has the right to take necessary and reasonable measures to conduct the meeting in an orderly manner, in accordance with the approved agenda and reflecting the wishes of the majority of the meeting attendees;

5. The General Meeting of Shareholders discusses and votes on each issue in the agenda. Voting is conducted by voting for, against and abstaining. The vote counting results are announced by the chairperson immediately before the closing of the meeting, unless otherwise provided in the Company Charter;

6. Shareholders or authorized persons who arrive after the meeting has opened may still register and have the right to vote immediately after registration; in this case, the validity of the previously voted contents shall not change;

7. The person convening or chairing the General Meeting of Shareholders has the following rights:

a) Request all attendees to be subject to inspection or other legal and reasonable security measures;

b) Request the competent authority to maintain order at the meeting; expel those who do not comply with the chairman's authority, intentionally disrupt the order, prevent the normal progress of the meeting or do not comply with the security check requirements from the General Meeting of Shareholders;

8. The Chairman has the right to postpone the General Meeting of Shareholders with a sufficient number of registered attendees for no more than 03 working days from the date of the meeting's scheduled opening and may only postpone the meeting or change the meeting location in the following cases:

a) The meeting location does not have enough convenient seats for all attendees;

b) The means of communication at the meeting location do not ensure that shareholders attending the meeting can participate, discuss and vote;

c) There are attendees who obstruct or disrupt the order, posing a risk of making the meeting not be conducted fairly and legally;

9. In case the chairman postpones or suspends the General Meeting of Shareholders contrary to the provisions of Clause 8 of this Article, the General Meeting of Shareholders shall elect another person from among the attendees to replace the chairman in conducting the meeting until its conclusion; all resolutions passed at that meeting shall be effective.

Article 36: List of shareholders entitled to attend the General Meeting of Shareholders

1. The list of shareholders entitled to attend the General Meeting of Shareholders shall be prepared based on the company's shareholder register. The list of shareholders entitled to attend the General Meeting of Shareholders shall be prepared no later than 10 days before the date of sending the invitation to the General Meeting of Shareholders, unless the Company's Charter stipulates a shorter period.

2. The list of shareholders entitled to attend the General Meeting of Shareholders shall include the full name, contact address, nationality, legal document number of the individual for individual shareholders; the name, enterprise code or legal document number of the organization, head office address for organizational shareholders; the number of shares of each type, the number and date of shareholder registration of each shareholder.

3. Shareholders have the right to check, look up, extract, and copy the names and contact addresses of shareholders in the list of shareholders entitled to attend the General Meeting of Shareholders; Request to correct incorrect information or supplement necessary information about themselves in the list of shareholders entitled to attend the General Meeting of Shareholders. The company manager must promptly provide information in the shareholder register, correct or supplement incorrect information upon request of the shareholder; be responsible for compensating for damages arising from failure to provide or untimely or inaccurate provision of information in the shareholder register upon request.

Article 37: Agenda and content of the General Meeting of Shareholders

1. The person convening the General Meeting of Shareholders must prepare the agenda and content of the meeting.

2. Shareholders or groups of shareholders specified in Clause 2, Article 115 of the Law on Enterprises have the right to propose issues to be included in the agenda of the General Meeting of Shareholders. The proposal must be in writing and sent to the company at least 03 working days before the opening date, unless the Company Charter stipulates another time limit. The proposal must clearly state the name of the shareholder, the number of each type of shares of the shareholder, and the issues proposed to be included in the agenda.

3. In case the person convening the General Meeting of Shareholders refuses the proposal specified in Clause 2 of this Article, he/she must reply in writing and state the reasons no later than 02 working days before the opening date of the General Meeting of Shareholders. The person convening the General Meeting of Shareholders may only refuse the proposal if it falls under one of the following cases:

a) The proposal is sent in violation of the provisions of Clause 2 of this Article;

b) The proposed issue is not within the decision-making authority of the General Meeting of Shareholders.

4. The person convening the General Meeting of Shareholders must accept and include the proposal specified in Clause 2 of this Article in the proposed agenda and content of the meeting, except for the case specified in Clause 3 of this Article; the proposal shall be officially added to the agenda and content of the meeting if approved by the General Meeting of Shareholders.

Article 38: Invitation to the General Meeting of Shareholders

1. The person convening the General Meeting of Shareholders must send a notice of meeting to all shareholders on the list of shareholders entitled to attend the meeting at least 21 days before the opening date, unless the Company Charter stipulates a longer period. The notice of meeting must include the name, head office address, enterprise code; name, contact address of shareholders, time, location of meeting and other requirements for meeting attendees.

2. The notice of meeting must be sent by a method that ensures it reaches the contact address of shareholders and is posted on the company's website; if the company deems it necessary, it shall be published in a central or local daily newspaper in accordance with the provisions of the Company Charter.

3. The notice of meeting must be accompanied by the following documents:

a) Meeting agenda, documents used in the meeting and draft resolutions for each issue in the meeting agenda;

b) Voting ballot.

4. In case the company has a website, sending meeting documents together with the meeting invitation as prescribed in Clause 3 of this Article can be replaced by posting them on the company's website. In this case, the meeting invitation must clearly state where and how to download the documents.

Article 39: Form of passing resolutions of the General Meeting of Shareholders

1. The General Meeting of Shareholders shall pass resolutions within its competence by voting at the meeting or by obtaining written opinions.

2. Unless otherwise provided for in the Company Charter, resolutions of the General Meeting of Shareholders on the following matters must be passed by voting at the General Meeting of Shareholders:

a) Amendments and supplements to the contents of the Company Charter;

b) Company development orientation;

c) Types of shares and total number of shares of each type;

d) Election, dismissal, removal of members of the Board of Directors and the Board of Supervisors;

d) Decisions on investment or sale of assets with a value of 35% or more of the total value of assets recorded in the most recent financial statements of the company, unless the Company Charter stipulates a different ratio or value;

e) Approval of annual financial statements;

g) Reorganization and dissolution of the company.

Article 40: Minutes of the General Meeting of Shareholders

1. Minutes of the General Meeting of Shareholders must be recorded and may be audio-recorded or recorded and stored in other electronic forms. Minutes must be prepared in Vietnamese, and may be prepared in a foreign language, and must include the following main contents:

a) Name, head office address, enterprise code;

b) Time and location of the General Meeting of Shareholders;

c) Agenda and content of the meeting;

d) Full name of the chair and secretary;

d) Summary of the meeting proceedings and opinions expressed at the General Meeting of Shareholders on each issue in the agenda;

e) Number of shareholders and total number of votes of shareholders attending the meeting, appendix of the list of shareholders registered, shareholder representatives attending the meeting with the corresponding number of shares and votes;

g) Total number of votes for each voting issue, clearly stating the voting method, total number of valid, invalid, approval, disapproval and abstention votes; corresponding percentage of total votes of shareholders attending the meeting;

h) Issues approved and corresponding percentage of approved votes;

i) Full name and signature of the chairman and secretary.

In case the chairman and secretary refuse to sign the meeting minutes, the minutes shall be valid if signed by all other members of the Board of Directors attending the meeting and contain full content as prescribed in this clause. The meeting minutes shall clearly state the refusal of the chairman and secretary to sign the meeting minutes.

2. The minutes of the General Meeting of Shareholders must be completed and approved before the end of the meeting.

3. The chairman and secretary of the meeting or other persons signing the meeting minutes shall be jointly responsible for the truthfulness and accuracy of the content of the minutes.

4. Minutes prepared in Vietnamese and foreign languages have the same legal effect. In case of any difference in content between the minutes in Vietnamese and foreign languages, the content in the minutes in Vietnamese shall prevail.

5. Minutes of the General Meeting of Shareholders must be sent to all shareholders within 15 days from the end of the meeting; the sending of the vote counting minutes may be replaced by posting them on the company's website.

6. Minutes of the General Meeting of Shareholders, appendix of the list of shareholders registered to attend the meeting, resolutions passed and related documents attached to the meeting invitation must be kept at the company's head office.

Article 41: Minutes of Board of Directors meeting

1. Minutes of Board of Directors meetings must be recorded and may be recorded, recorded and stored in other electronic forms. Minutes must be prepared in Vietnamese and may be prepared in a foreign language, including the following main contents:

a) Name, head office address, enterprise code;

b) Time and location of the meeting;

c) Purpose, agenda and content of the meeting;

d) Full name of each member attending the meeting or authorized person attending the meeting and method of attending the meeting; full name of members not attending the meeting and reasons;

d) Issues discussed and voted on at the meeting;

e) Summary of opinions expressed by each member attending the meeting in the order of the meeting;

g) Voting results, clearly stating members who approve, disapprove and have no opinion;

h) Issues passed and corresponding percentage of votes passed;

i) Full name and signature of the chairperson and the person recording the minutes, except for the case specified in Clause 2 of this Article.